The Emerging Markets Story – Value Coupled with Volatility

- brookewilen

- Sep 1, 2018

- 6 min read

Updated: Apr 16, 2019

"The stock market is filled with individuals who know the price of everything, but the value of nothing." - Phillip Fisher

My wife’s family is from Granada, Nicaragua. Granada is a beautiful lakeside town, popular with tourists and widely known for its Spanish colonial architecture. Over the years, I have made maybe six or seven trips to Nicaragua with my wife, and each time we visit the people appear better off financially, healthier and more optimistic. We always have a fabulous time touring the country, seeing family and friends along the way, and eating – yes eating at every stop.

I fear the good times are on hold for a while. Nicaragua is the poorest country in Central America and the second poorest in the Western Hemisphere after Haiti. The government led by President Daniel Ortega has been cracking down hard on student protestors and activists after they flooded the streets this past April in response to a proposed tax increase to fund the country’s pension system. The protests have escalated into a broader opposition against President Ortega who has been in office since 2007. Ortega, a notable Cold War antagonist of the United States also served as president in the 1980s during Nicaragua’s civil war. Some news organizations estimate 300+ civilians have been killed and 2000+ have been injured over the past five months.

The turmoil surrounding Nicaragua is sad but typical of developing countries throughout the world. As investors, we observe similar stories playing out time and time again, yet we are enticed by both the cheapness and the potential investing in these countries presents. We understand there is no such thing as a free lunch and so we accept the old adage that with greater risk comes greater reward.

A large part of investing is finding value, but an equally important aspect is the story. Emerging markets possess both value (they are cheap) and a good story (higher growth rates compared to developed countries). Despite the increased level of political volatility seen in less developed nations, the current relative U.S dollar currency strength (which is largely due to the Federal Reserve’s steady increase in the overnight target interest rate), or President Trump’s consistent threat of trade wars - is there anything out of the ordinary going on in the world of emerging markets investments? Nir Kaissar, a Bloomberg columnist recently answered this question with a resounding “no!”

For this month’s investment outlook, I am passing along the below Bloomberg opinion piece “It’s Not Time to Hit the Ejector Seat on Emerging Markets,” by Nir Kaissar. Many market commentators have focused on the 20% decline in emerging markets equities year to date as measured by the MSCI emerging markets index, however what they fail to mention is that this pull back occurred during a period from the start of 2016 in which the MSCI emerging markets index had previously increased by 93%. I am broadly constructive on emerging markets as an investment class and believe cheap valuations along with the potential for consistent higher growth rates are factors that merit inclusion in portfolios for long term investors who desire outperformance.

*****

It’s Not Time to Hit the Ejector Seat on Emerging Markets - Bloomberg

By Nir Kaissar September 6, 2018

This is no time to panic about emerging markets.

Imagine you hadn’t read the headlines about emerging markets this week. You didn’t know that South Africa slipped into a recession, or that the currencies of Turkey, Argentina and Indonesia are near record lows, or that seemingly every emerging-market analyst predicts that the trouble will spread to other developing countries.

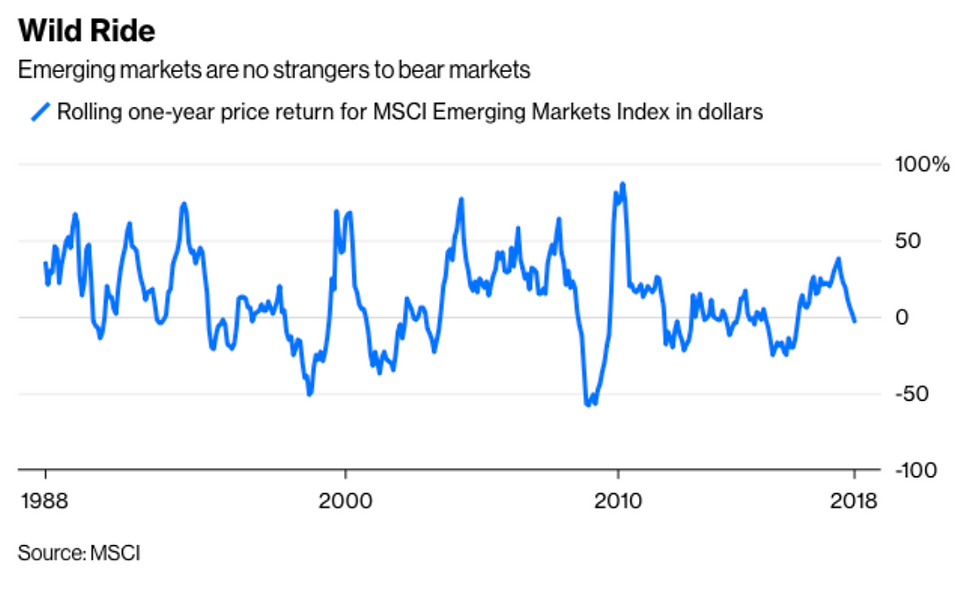

Instead, all you would have are the numbers showing how emerging-market stocks have behaved in the past. You would see that the MSCI Emerging Markets Index returned 8 percent annually in dollars since 1988 through August, excluding dividends, and that the volatility, as measured by annualized standard deviation, was 23 percent during the period.

You would quickly deduce that emerging-market stocks are a wild ride. The EM index can be expected to decline more than 40 percent of the time and enter bear market territory — a decline of 20 percent or more — close to a third of the time. You would then notice that the EM index has fallen by 19.7 percent in dollars from its peak on Jan. 26 through Wednesday and most likely conclude that nothing unusual was happening.

That stands in stark contrast to the alarm surrounding emerging markets, which isn’t to say they don’t have problems. Writing for Bloomberg Opinion on Tuesday, Satyajit Das laid out a laundry list of legitimate concerns including high debt, misallocated capital, “a weak banking sector, budget deficits, current-account gaps, substantial short- term foreign-currency debt and inadequate forex reserves” and “narrowly based industrial structures, reliance on commodity exports, institutional weaknesses, corruption and poor political and economic leadership.” And let’s not forget their sagging currencies. The MSCI Emerging Markets Currency Index — a basket of currencies that tracks the country allocations in the EM index — is down 8.6 percent from its peak on April 3 through Wednesday.

There’s evidence that when emerging-market currencies tumble, stock prices tend to follow, even after accounting for the currency fluctuation. The correlation between one- month price changes in the EM currency index and the stock index in local currency was 0.92 from 1998 through August, or a near-perfect relationship. That correlation declined only modestly to 0.7 over rolling one-, three- and five-year periods. So, it’s not surprising that the EM index is down 4.2 percent in local currency since currency prices peaked on April 3.

But here’s the thing: Investors turn to emerging markets for high growth, not stability. That growth is possible because emerging markets are building from a smaller base, which is just another way of saying that developing countries are, well, still developing and stumble often. This is a good time to remember that the premium investors expect from emerging markets over time is compensation for their willingness to remain invested when those growing pains show up.

The problem, of course, is that investors struggle to stay in their seats. Morningstar calculates investor returns for 68 mutual funds that have invested in emerging-market stocks over the last 15 years through August, including the various share classes. The average fund returned 9.1 percent annually over that period, including dividends, while the average investor in those funds captured just 6.5 percent.

And they’re at it again. Investors pulled a net $4 billion from emerging-market exchange-traded funds from February to August, according to Bloomberg Intelligence. That follows inflows of $25 billion in 2016 and $54 billion in 2017, both years in which emerging-market stocks posted strong returns.

It’s not just ordinary investors who run for the exits when emerging markets become wobbly. As my colleague Shuli Ren pointed out on Wednesday, in the last month hedge funds “sold down their positions in emerging markets to levels last seen in August 2015.”

Bailing out of a roller coaster midway through the ride is never a good idea. The same could be said about emerging markets right about now. *****

Sincerely,

Justin Kobe, CFA Founder & Portfolio Manager

Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Cambridge and Pacificus Capital Management are not affiliated.Material discussed is meant for general illustration and/or informational purposes only, and it is not to be construed as investment, tax, or legal advice. Although the information has been gathered from sources believed to be reliable, please note that individual situations can vary. Therefore, the information should be relied upon when coordinated with individual professional advice. These are the opinions of Justin Kobe and not necessarily those of Cambridge Investment Research, are for informational purposes only, and should not be construed or acted upon as individualized investment advice. Investing in the bond marketis subject to risks, including market, interest rate, issuer credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies is impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and the current low interest rate environment increases this risk. Current reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Diversification and asset allocation strategies do not assure profit or protect against loss.

Comments